Website link your checking account. Url your bank account so Cleo can confirm your immediate deposit exercise. This lets you develop into qualified for cash improvements.

The most common rate to look for with a personal personal loan is really an origination payment. This is frequently one% to ten% on the bank loan quantity, and it might be added to the whole loan total or subtracted from it prior to deciding to obtain the cash.

Even in an unexpected emergency, having time to check own loans and probably cheaper selections could help you save cash and allow you to avoid unsafe lenders which will damage your credit and finances.

We will require your birthdate and the final 4 digits of your respective social for identification reasons. When you are finished supplying this information, click on to carry on.

A personal loan with a extensive repayment term and very low regular monthly payment may feel appealing, however it expenses much more in overall fascination. Seek out a proposal that balances inexpensive month to month payments with reasonable desire expenses.

The business receives good ratings on copyright, nonetheless it fees steep charges, earning this selection best for emergencies only.

For a helpful reminder, very carefully review the eligibility requirements with the loan ahead of applying to boost your probabilities of approval. Examine up over the terms and conditions and merchandise disclosure assertion and contact the bank should you want any clarifications about the plan.

Editorial Notice: Intuit Credit score Karma receives payment from third-celebration advertisers, 24 hour cash loans but that doesn’t impact our editors’ opinions. Our third-occasion advertisers don’t overview, approve or endorse our editorial articles.

LightStream doesn’t disclose its correct specifications, nonetheless it only approves borrowers with great to superb FICO scores. LightStream borrowers generally have:

For those who have very good to excellent credit score, LightStream is among the best choices for an unexpected emergency personal loan. It’s known for having competitive charges, no origination expenses, fast funding, large bank loan quantities and repayment versatility.

Although these bad credit lenders tend to possess flexible approval needs, like loans without having credit Verify, you still have to display some sort of regular income to qualify — like from the position, government Rewards or kid assistance.

These choices properly Enable you to entry your personal income early, rather then providing extra cash that you simply repay after some time, so make certain you can fulfill your other every month economical obligations with a rearranged pay back agenda.

Key Points:LendingClub own loans absolutely are a good choice for fantastic-credit score borrowers trying to consolidate debt and build their credit history.

Vital Specifics:A Universal Credit history personal loan is actually a sound selection for bad-credit score borrowers seeking to build credit rating, but prices are superior compared to identical lenders.

Brandy Then & Now!

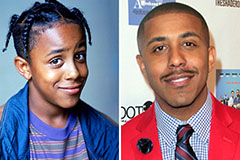

Brandy Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now! Morgan Fairchild Then & Now!

Morgan Fairchild Then & Now!